2026 Global Specialty Chemical Additives Outlook

Entering 2026, the global specialty chemical additives industry stands at a pivotal crossroads. We are witnessing a fundamental reconstruction of the market, driven by the simultaneous elevation of "regulatory compliance" and "performance benchmarks." This transition is not merely the result of isolated technical breakthroughs but a structural evolution fueled by tightening institutional mandates, increasingly aggressive processing conditions, and shifting end-market demands.

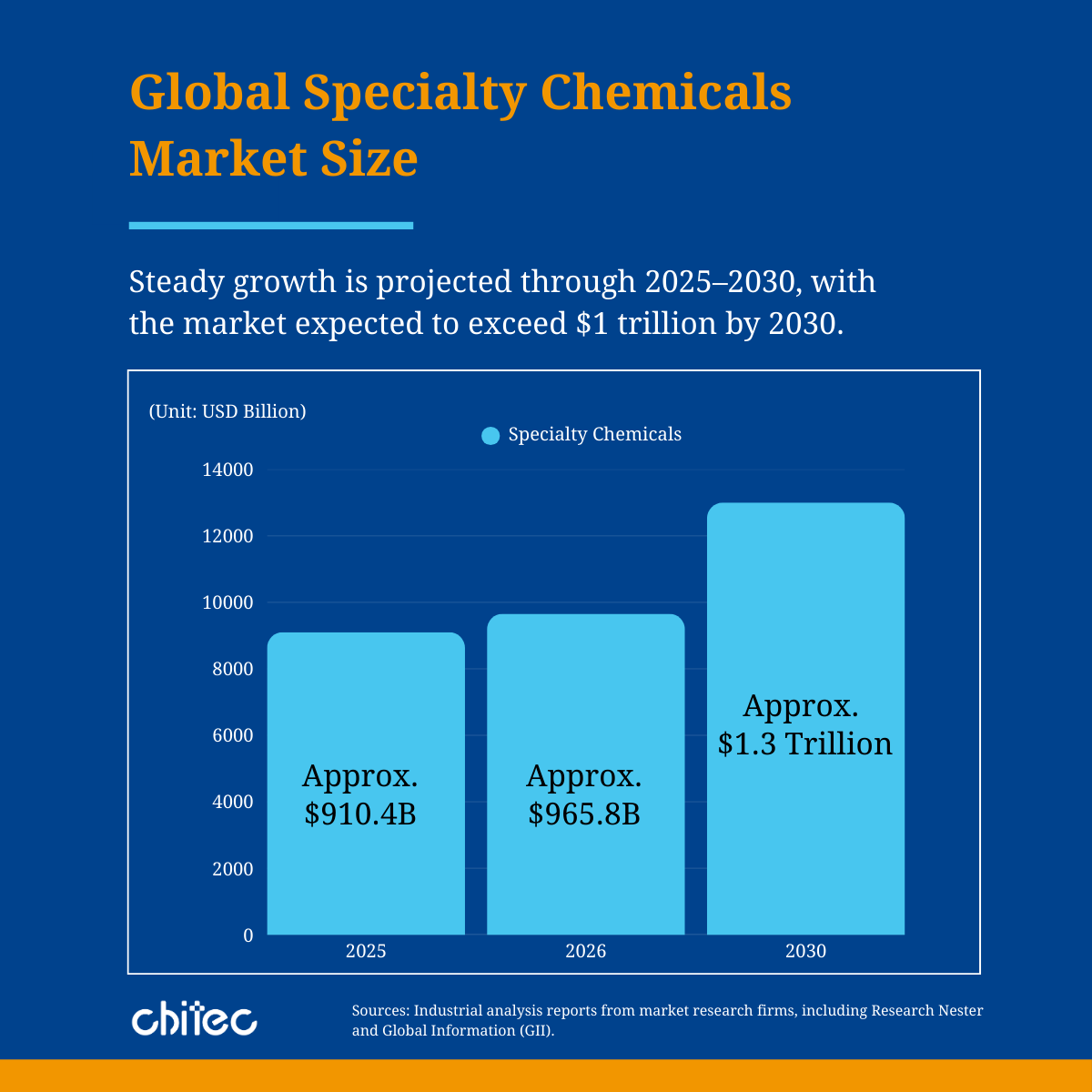

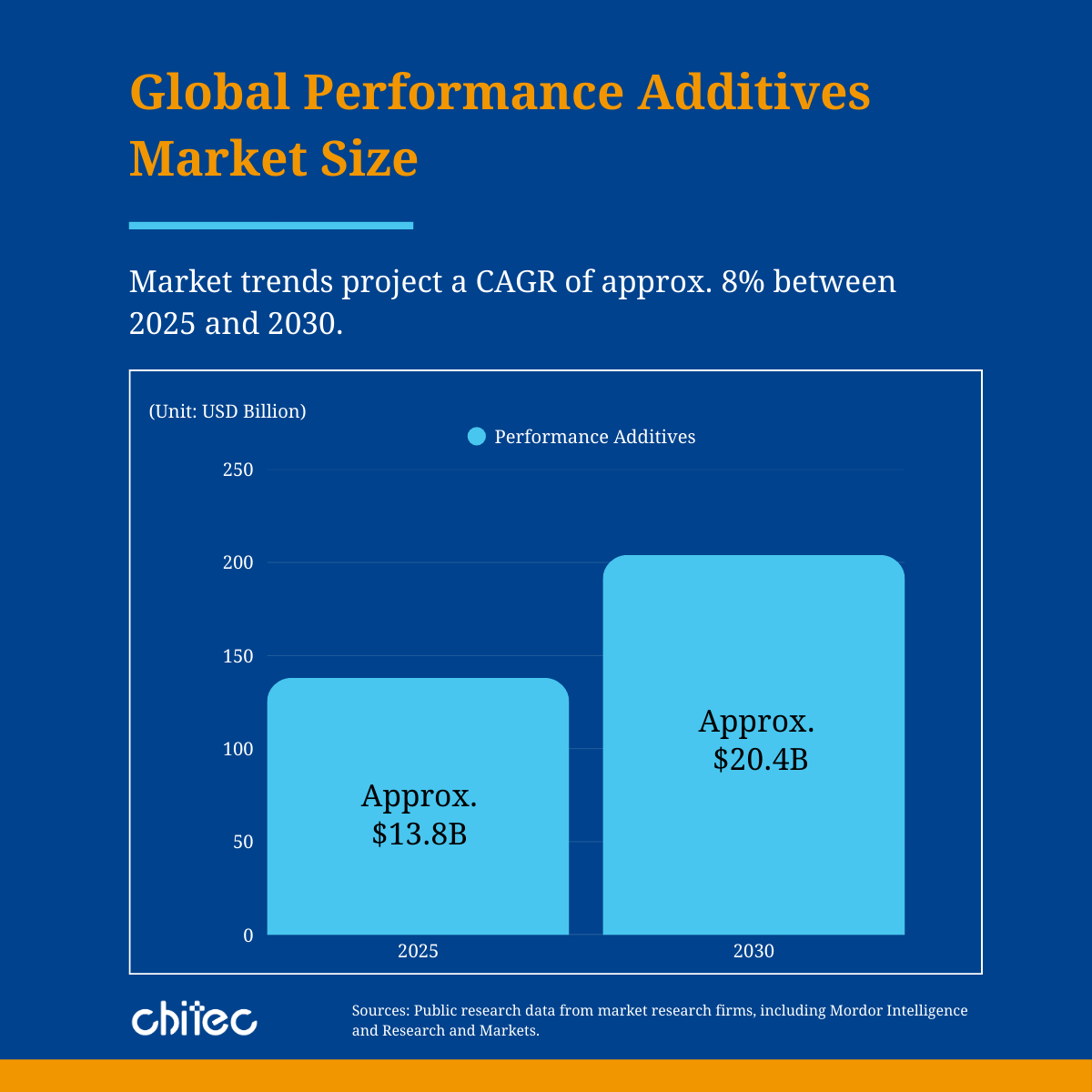

From a macro perspective, specialty chemicals continue to demonstrate robust growth. Global market valuation reached approximately $910.4 billion in 2025 and is projected to climb to $965.8 billion in 2026, on track to surpass the $1.3 trillion milestone by 2030. Within this landscape, the functional additives segment—valued at $13.819 billion in 2025—is forecasted to reach $20.361 billion by 2030, maintaining a healthy CAGR of 8.06%.

However, the most significant shift is not found in market volume, but in the strategic role additives play within the material value chain.

In 2026, additives have evolved beyond their traditional role as auxiliary stabilizers. They are now decisive risk-control factors that dictate material adoption, regulatory feasibility, and a brand’s ability to mitigate long-term liability and compliance risks.

In this new landscape, competition is gravitating toward "Material Sovereignty." Verified and traceable molecular architectures are becoming the cornerstone of high-stickiness, long-term supply partnerships. Simultaneously, the demand for additives that can bridge the gap between extreme processing durability and long-term weatherability is shifting the market from cost-centric procurement to a value-driven model: the "Functional Premium."

Irreversible Regulatory Transition: Compliant Substitution as a Mandate

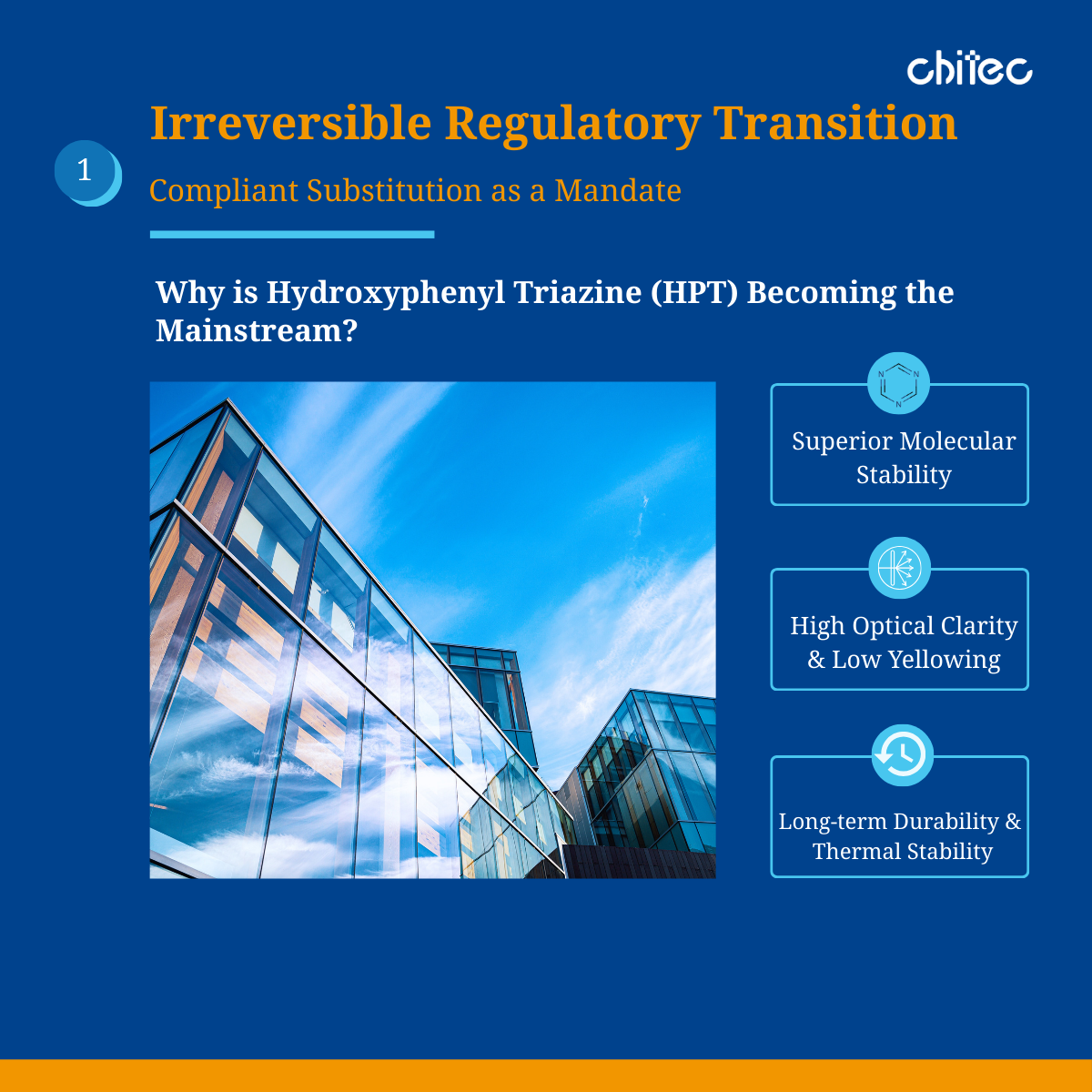

The UV stabilizer segment has become the primary battleground for these regulatory shifts. With the 2025 inclusion of UV-328 in the Stockholm Convention’s Annex A elimination list, the industry has reached a point of no return. Anticipating this disruption, Chitec proactively phased out UV-328 as early as 2020, positioning itself as a leader in long-term compliance strategy.

Today, the market is rapidly pivoting toward next-generation molecular designs that offer low migration, superior thermal stability, and enduring photo-stability. In this environment, Hydroxyphenyl-triazine (HPT) has emerged as the definitive successor. Its adoption is driven by its unique ability to mitigate high-temperature processing risks while significantly enhancing end-product reliability.

Strategic first-movers will command the transition toward regulatory compliance

While many are only now reacting to these changes, forward-thinking enterprises have already established dominance along alternative technological paths. Chitec Technology, for example, initiated R&D and productization for Triazine-based UV absorbers well before the regulatory landscape matured. This proactive positioning allows Chitec to leverage a mature technical foundation and mass-production expertise to support customers through material validation, process integration, and long-term supply planning.

By 2026, the UV stabilizer market has transcended price-driven competition, entering a watershed era defined by regulatory depth, technical sophistication, and supply chain resilience.

Extreme Processing: Competition Shifts to Manufacturing Stage

The rise of AI high-compute servers, EV power modules, and 5G/6G infrastructure is pushing plastics to their physical limits. Higher processing temperatures and stricter reliability requirements have become the norm. Global engineering plastics are expected to maintain a 6%–8% CAGR through 2030, underscoring the structural nature of this demand.

For manufacturers, the challenge is practical: Can yield be maintained at processing temperatures exceeding 300°C? Traditional additives often fail under these conditions, leading to mold fouling, color instability, and exudation—all of which degrade Overall Equipment Effectiveness (OEE) and erode margins.

This has catalyzed a shift toward a "Structural Anchoring" design philosophy. By utilizing advanced side-chain engineering, modern additives remain securely embedded within the polymer matrix even during high-heat melt processing. For high-aesthetic electronic and automotive components, the true value lies in proven Low Volatility, Low Migration, and Low Exudation performance.

Waterborne Coatings: Beyond Low VOC

In 2026, the waterborne coatings sector is looking beyond VOC compliance toward Scope 3 carbon footprint controllability. In global trade, shipping water is increasingly viewed as an unnecessary carbon and cost burden. For high-end applications, this logistics inefficiency is no longer sustainable.

The industry is moving toward anhydrous liquid and high-active-content designs. By replacing water with functional carriers, these additives drastically reduce transportation footprints and improve logistics efficiency. Furthermore, these anhydrous systems offer superior low-temperature stability and reduce the need for preservatives, simplifying global inventory management.

The "Precision Band" Era in Optical and Display Supply Chain

As display technology permeates everything from automotive cockpits to AR/VR wearables, the margin for error in optical material has vanished. Any degradation in clarity or color shift is now a critical brand risk. Consequently, additive R&D has entered the era of precise spectral control.

While traditional UV absorption focused on the sub-400 nm range, modern requirements demand the management of High-Energy Visible (HEV) light above 400 nm. The goal is to maximize eye protection and display longevity without compromising color fidelity. The solution lies in narrow-band, sharp-cut capabilities—additives that function with surgical precision to minimize visual fatigue while keeping the material within strict color-shift tolerances.